Best accounting software for small businesses

Just like figuring out what type of business insurance you need or what website builder to use, setting up accounting software for your company or venture is a no-brainer for making your life easier and ensuring small business success.

Thanks to the boom of side hustlers and small businesses over the past few years, accounting software platforms have taken notice and made it easier than ever for anyone to organise and automate their financial records and get insights into how their business is going themselves.

But, which one is right for your business? This guide runs through the best accounting software on the market, including the free accounting software that’s available.

Do I need accounting software for my small business?

While using accounting software is not a legal requirement, it’s worth thinking about, regardless of whether you’re a sole trader or limited company.

If you’re a sole trader, accounting software will make your tax return a lot easier to complete and give you clear insight into your upcoming tax obligations. If you’re a limited company, it will help you to complete finance-related tasks, such as bookkeeping, invoicing, inventory and payroll.

With the Government’s roll-out of Making Tax Digital, which is already live for VAT filing, using digital accounting software with month-to-date filing built-in will also make things much simpler to submit to HMRC.

What are the benefits of accounting software for small businesses?

The biggest draw with any accounting software is the ability to view everything in one place and understand how your business is performing in an instant.

Alongside this, small business accounting software streamlines your finance and accounting responsibilities by automating some processes, so you don’t have to worry about inputting information manually. On top of that, many also include reporting features, so you can track your incomings and outgoings, spotting any causes for concern in real-time and acting accordingly.

Some other benefits include:

- Saving valuable time that you can use elsewhere in your business

- Saving money – by collaborating with your accountant using real-time data

- Gaining a complete understanding of your business’ financial health

- Reducing manual admin and minimising errors

- Collaborating easily with multiple teams on one platform

Another advantage is that most accounting software is cloud-based with mobile app options, which allows you to access your accounts from anywhere at any time.

What is cloud-based accounting software?

Cloud-based accounting software – also called web-based or online accounting software – keeps your accounting online, so you can access them from various devices such as a laptop, tablet or phone, which is made easier if the company has an app. This type of software is particularly useful if you have several employees or teams that need to report from multiple locations or regularly take pictures of receipts through document capture.

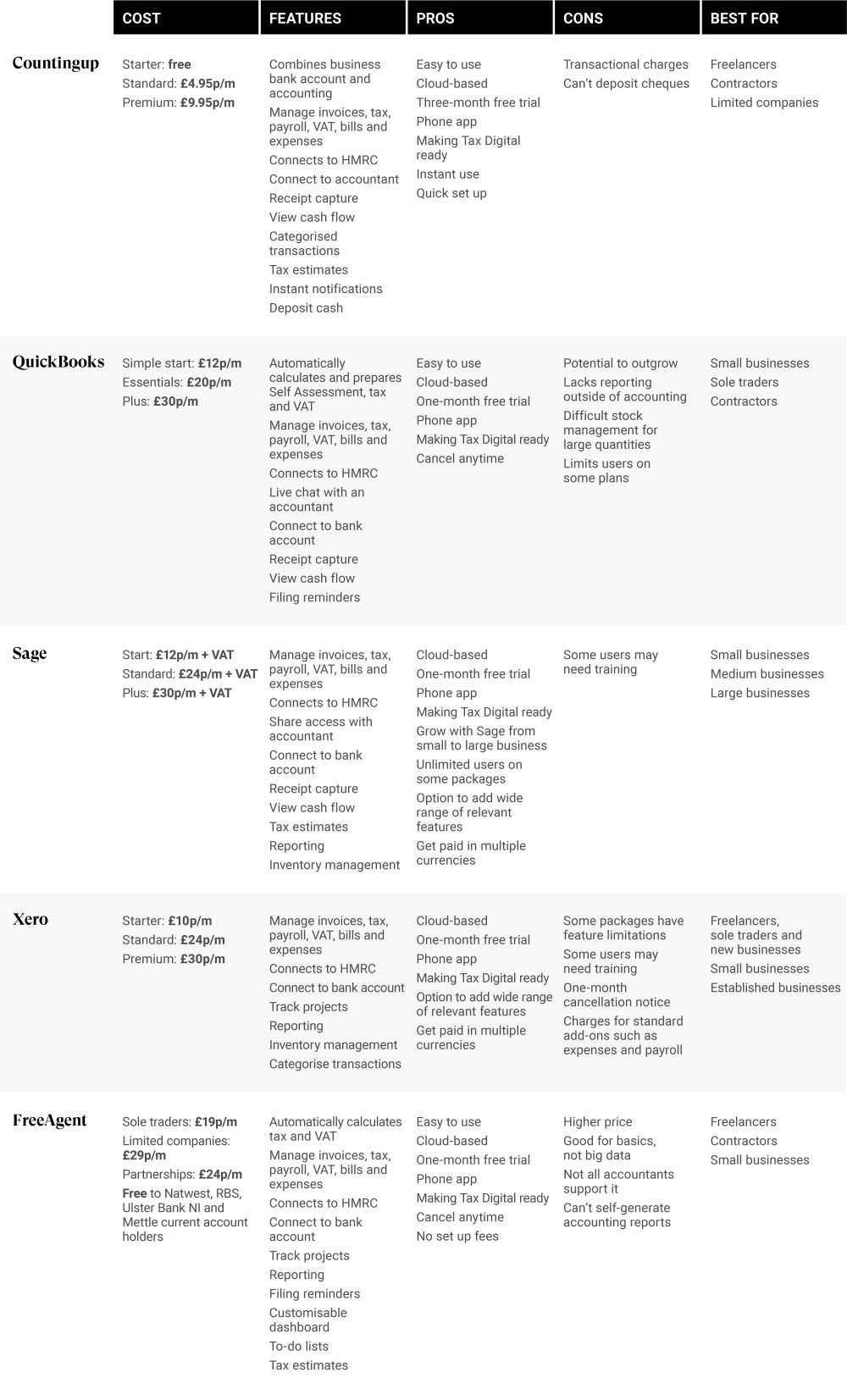

The best accounting software for small businesses

With so many available, it can be difficult to gain a full picture of the key differences between accounting software platforms for you to decide which one would be most suitable for your business. While relatively similar in what they offer, each one has slightly different features and user interfaces, which may be more relevant for what you need.

Let’s run through some of the top accounting software programs and their varying characteristics so you can get a better idea of which to choose.

Countingup

Countingup combines a business bank account and accounting software into one app, meaning you can pay for bills, complete accounting tasks and send invoices in one place. When you sign up, you’ll be sent a contactless Mastercard to use for your business transactions, which will connect to the app.

Who is it suitable for?

Freelancers, contractors and limited companies that have up to two directors. Not suitable for larger businesses that employ a lot of staff.

How much is Countingup?

Countingup offers three pricing options:

- Starter: a free account plan for those earning up to £500 a month.

- Standard: costs £4.95 a month for those earning between £500-£4000 a month.

- Premium: costs £9.95 a month for those earning over £4000 a month.

Keep in mind that these prices are not inclusive of all transactions, meaning Countingup charge for things like ATM withdrawals and account transfers.

What are the features?

- Create and send unlimited invoices

- Uses real-time profit and loss data to give you financial insights

- Connect and share bookkeeping data with your accountant from the app

- Receipt capture functionality helps you track expenses

- Automatically categorised transactions

- Instant notifications including invoices paid

- Ongoing tax estimate

Pros

- Offers a three-month free trial

- Quick set up and instant use

- Deposit cash into the account from the Post Office or PayPoints, however this incurs a 3% charge

- A network of over 2200 accountants

Cons

- If you’re already set up with a business bank account and accounting software, you’ll need to switch, which can be time-consuming and cumbersome, depending on who you are banking or operating with

- Transactional charges

- Can’t deposit cheques

QuickBooks

As one of the most well-known accounting software platforms on the market, QuickBooks is recommended by most accountants. It supports all kinds of accounting, from sole traders who just want help with their Self Assessment to small businesses who want to add VAT and payroll. QuickBooks also gives its members access to over 700 third party apps in its marketplace, letting you add-on features that are most relevant for what you need.

Who is it suitable for?

Quickbooks has been specifically designed for small businesses, but it does have the capabilities to support sole traders and contractors, too.

How much is QuickBooks?

QuickBooks offers three payment options centred around the type of business you have.

- Simple start: for sole traders and new small businesses that manage VAT, income tax and expenses – £12 a month, plus 20% VAT

- Essentials: for small-but-growing businesses that work with suppliers – £20 a month, plus 20% VAT

- Plus: for established businesses that manage stock and projects – £30 a month, plus 20% VAT

What are the features?

- Automatically organises, calculates and prepares Self Assessment, VAT and Construction Industry Scheme tax

- Connects to HMRC to upload directly

- Manage taxes, payroll, invoices, bills and expenses in one place

- Reminders of filing due dates

- Receipt capture to manage expenses

- Connect your bank account

- Overview of cash flow, including a 90-day forecast based on your incomings and outgoings

- Create customised invoices and automatically send reminders to get paid

- Chat live with accounting professionals when you need help

- The marketplace allows you to connect over 700 add-on apps depending on what you need

Pros

- Cancel anytime

- Free one-month trial

- Easy to use

- Making Tax Digital ready

Cons

- There is the potential for you to outgrow QuickBooks if you become a larger business

- Lacks custom or key industry reports outside of accounting

- There have been reports of stock management being difficult for those with large stock volumes

- Limits the number of users on the Essentials and Plus plans to 3 and 5 respectively

Sage

Sage cloud accounting is a cloud-based platform that offers a quick set up, a real-time overview of your finances, automation for a lot of processes and the ability to give access to your accountant. It’s been a trusted solution by many sole traders and small businesses because of how it provides scalability and flexibility.

Who is it suitable for?

Small businesses with the capacity to upgrade as your business grows.

How much is Sage?

- Start: £12 a month, plus VAT

- Standard: £24 a month, plus VAT

- Plus: £30 a month, plus VAT

What are the features?

- Create, send and manage unpaid invoices

- Track payments and expenses

- Syncs with your banking software

- Create and send VAT reports

- Pull a range of reports beyond accounting

- Calculate estimates and send quotes

- View cash flow and Sage’s forecasting

- Receipt capture

- Get paid in multiple currencies

- Complete inventory

- Share access with your accountant

- Run payroll and pay your employees

Pros

- Capacity to use Sage as a one-person operation to a large business

- Has the option to add a huge range of relevant features

- Unlimited users for the Standard and Plus packages

- Free one-month trial

- Enjoy the features on a phone, tablet or laptop

Cons

- Some customers report that if you’re not clued-up on accounting jargon, you may find the system harder to navigate, meaning users may need training

Xero

Similar to QuickBooks and Sage, Xero is a cloud-based accounting software platform that’s optimised for small businesses and offers standard features such as invoicing, cash flow overview, expenses, payroll, VAT and bank connections. The main difference is in Xero’s user interface, which is apparent through their tagline “Beautiful business”. The company aims to make accounting smooth running and enjoyable with a simple but effective tool.

Who is it suitable for?

Xero offers three packages that are most suitable for:

- Freelancers, sole traders and new businesses

- Small businesses

- Established businesses

How much does Xero cost?

Xero’s pricing packages reflect who they’re most suitable for, with limitations to the cheaper packages.

- Starter: £10 per month

- Standard: £24 per month

- Plus: £30 per month

What are the features?

- Pay bills

- Automatically calculated VAT that you can file securely with HMRC

- Claim expenses

- Connect to your banking

- Track projects

- HMRC-recognised Payroll software

- Categorise bank transactions

- Document capture

- Pull accounting reports

- Inventory management

- Do business in over 160 currencies

- Create and send quotes, purchase orders and invoices

Pros

- Incredible amount of app integrations in the app marketplace that are made for a wide range of industries

- Making Tax Digital ready

Cons

- The starter packs have limitations on invoices, bill entry and currencies

- Some training may be required to get used to the interface

- Cancellation requires a one-month notice

- You have to pay for add-ons such as payroll, claiming expenses and tracking projects

FreeAgent

FreeAgent is a cloud-based accounting platform that focuses on admin tasks such as invoices and expenses. One of the main draws is that their software is designed for the customer instead of the accountant, so it’s praised for being easy to use. They have a mobile app that offers all the features of their desktop version and they offer tailored plans that include relevant features for your specific set up.

Who is it suitable for?

Freelancers, contractors and small businesses.

How much does FreeAgent cost?

FreeAgent offers both monthly and annual plans, with the latter saving you up to 45%. To get an idea of their pricing, here are their monthly subscription rates:

- Sole traders: £9.50 + VAT for the first six months, £19 after.

- Limited companies: £14.50 + VAT for the first six months, £29 after.

- Partnerships: £12 + VAT for the first six months, £24 after.

If you have a Natwest, Royal Bank of Scotland, Ulster Bank NI business banking current account or a Mettle account, you can use FreeAgent for free.

What are the features?

- A personalised tax timeline of upcoming deadlines and payments that are due

- Auto populates Self Assessment and MTD-compatible VAT returns and allows you to file them straight from the platform

- Syncs with your bank account

- Connects directly to HMRC

- Calculates corporation tax as you go, so you know how much you owe

- Create, send and track professional-looking invoices

- A to-do list to help you tick off admin tasks

- Customisable dashboard gives an overview of everything you need

- Quick access to financial reports

- Manage expenses and create estimates

- Track time spent on clients or projects

Pros

- Cancel any time and FreeAgent will let you download your data

- One-month free trial

- Easy to use software

- No set-up fees

Cons

- Some report that the pricing is slightly higher than other offerings

- It’s good for the basics but doesn’t delve too deeply into big data

- Not all accountants support the platform

- Can’t generate accounting reports yourself

Futrli

Futrli is AI-powered cash flow forecasting software that helps businesses future plan their finances. While it’s not strictly accounting software, it does connect to Xero and QuickBooks, so you can manage your cash flow and your accounts simultaneously. Not only does it help you see predictions but through education and advice, it helps small businesses understand their cash flow and become financially savvy so they can make better business decisions.

Who is it suitable for?

Small businesses and their accountants.

How much does Futrli cost?

The pricing is shown in dollars and all three tools have a 7-day free trial.

- Just Predict: $37 annually, $49.50 monthly

- Flow add-on: $11.25 annually, $15 monthly

- Advisor package: $49.99 per month

Superscript customers can receive 50% off Futrli using the code 'Superscript50'.

What are the features?

- Predicts tax, sales, expenditure, payments, cash, invoices and staff costs

- 3-year cash flow predictions based on data and algorithms

- See how your business decisions will affect cash flow, such as cost savings and staff changes

- Connects to Xero and QuickBooks

- Monitors invoices and billing to pay and get paid on time

- Automate an action feed to stay on top of to-dos

- Track actual vs. forecast with reporting

Pros

- Connects to Xero and QuickBooks

- Provides education and advice

- Clear data visualisations

- Removes manual work through automation

Cons

- Can’t combine companies trading in different currencies

To sum up

QuickBooks, Sage and Xero are the largest accounting software platforms around and will be recognised by most accountants. While FreeAgent is similar, it’s slightly smaller and not as well known, so may not always be supported. And Countingup offers a unique product that could streamline even more of your processes.

We hope this guide to small business accounting software has helped you pick the one that’s right for you. If you think your network would benefit from this information, why not share this guide on your social channels.

Disclaimer: information and prices are correct at time of publication - 5th May 2021.